BLOG

New Jersey Car Accident Claim Process: PIP Rules, Timelines, and How to Protect Your Compensation

A car crash can turn an ordinary day into a confusing admin storm. You are dealing with shock, car repairs, pain that may not show up straight away, and then the paperwork starts. Insurance questions arrive fast, and the wrong answer at the wrong time can shrink your claim later.

New Jersey adds another layer because it is a no-fault state for injuries in many situations. That means your own policy and your own Personal Injury Protection, usually called PIP, often pays medical bills first, even when the other driver caused the crash.

This guide explains the New Jersey car accident claim process from the first day through settlement or litigation. It is written to help you avoid common traps, understand how PIP interacts with a claim against the other driver, and recognise when it is time to speak with a lawyer. Lynch Lawyers focuses on car accident cases in New Jersey and can review your situation in a free consultation.

Why New Jersey car accident claims feel confusing

Many people assume a claim is one thing. In reality, you may be dealing with more than one track at the same time.

One track is medical bills and treatment. In New Jersey, PIP is central because it can pay for medical expenses regardless of fault.

Another track is compensation beyond medical treatment, such as pain and suffering, full lost income, and the long term impact of an injury. That side of a claim often depends on liability, evidence, and legal thresholds that can be easy to misunderstand.

The confusion usually starts when people treat an insurer as a neutral helper. Insurance companies have procedures, and those procedures are not designed to maximise your recovery. They are designed to evaluate, limit, and close claims. The earlier you understand that, the better you can protect your position.

The first 24 hours after a crash: what matters most for your claim

The first day is about safety first, then documentation. You do not need to be perfect at the scene. You just need to do a few sensible things that help later.

Safety and getting help at the scene

Check for injuries, move to safety if you can, and call emergency services when needed. Even if you feel fine, pay attention to symptoms. Adrenaline can mask pain, and some injuries become clearer over the next day or two.

Police reports and why documentation matters

A police report can become a key piece of neutral documentation. It may record location, parties involved, witness details, and initial observations. Insurers take police reports seriously, even when they disagree with parts of them.

If the police do not attend, New Jersey has a process for self-reporting certain crashes. The state crash report form explains that if a crash involves injury or death, or property damage over a threshold, the driver must forward a written report within ten days.

Photos and witnesses without overthinking it

If it is safe to do so, take photos of vehicle positions, damage from multiple angles, road conditions, signage, and any visible injuries. Collect contact details for witnesses. A short note about what they saw can help later if memories fade.

Try not to rely on the idea that the truth will be obvious. Liability is often argued, especially when injuries are involved.

What not to say to the other insurer

In the hours after a crash, people often say too much. Avoid making statements about fault, speed, or what you “should have done.” Avoid guessing about injuries, especially saying you are fine if you are not sure. Keep communication factual.

If an insurer asks for a recorded statement early, be cautious. It can lock you into wording before you have the full picture of your injuries and treatment needs.

Understanding New Jersey no fault and PIP in plain English

PIP is one of the most important concepts in the New Jersey car accident claim process. It is sometimes called no-fault coverage because it can pay your medical costs regardless of who caused the crash.

What PIP covers and what it does not

PIP commonly covers medical treatment related to the crash and can also include other benefits depending on your policy. The New Jersey Department of Banking and Insurance explains the basic concept clearly: PIP pays for injuries under your policy and is called no-fault because it pays no matter who caused the accident.

However, PIP does not automatically equal full compensation for everything you lose. Pain and suffering and other non-economic damages usually sit outside the PIP structure and can depend on your right to sue option and the seriousness of your injuries.

Getting medical treatment without putting your claim at risk

Delaying treatment is one of the easiest ways to weaken a claim. It creates a gap that insurers may use to argue the injury was not serious, not caused by the crash, or not treated consistently.

The practical approach is simple. If you feel pain, dizziness, numbness, or unusual symptoms, get assessed. Follow up if symptoms change. Keep records of appointments, referrals, and recommended treatment.

PIP limits, denials, and common disputes

PIP disputes often revolve around whether treatment was necessary, whether it was related to the crash, and whether the paperwork was handled correctly. This is one reason people speak with a lawyer early, especially if treatment is delayed or denied.

When a claim against the other driver becomes relevant

Even with PIP, you may still have a claim against the at-fault driver for other damages. New Jersey also has rules about limiting lawsuits depending on the policy option chosen. The New Jersey courts' jury charge material discusses the limitations on lawsuit options in the auto insurance context, which highlights that there can be restrictions on suing unless certain criteria are met. (NJ Courts)

The key point is that no fault does not mean nobody is at fault. It means your own coverage may pay first for certain benefits, while fault still matters for broader compensation.

Step by step: how a New Jersey car accident claim usually unfolds

Every case is different, but the process tends to follow a predictable pattern.

Opening the claim and notifying insurers

You notify your own insurer and, when appropriate, the other driver’s insurer. Early reporting matters. It helps preserve coverage and starts the documentation trail.

Medical records, treatment timeline, and consistency

Your medical records are the backbone of an injury claim. They show diagnosis, symptoms, treatment, and progress. Consistency matters because insurers look for gaps, missed appointments, or sudden escalations that seem unsupported.

Evidence gathering and investigation

Evidence includes photos, witness statements, vehicle damage, scene details, phone records when relevant, and medical documentation. In more serious cases, investigators may look for camera footage, download vehicle data, or reconstruct the crash.

This is where a firm like Lynch Lawyers brings value. A strong case is built, not assumed.

Demand package and negotiation

Once there is clarity on injuries, treatment, and future needs, a demand is typically made. It outlines liability, damages, medical costs, lost income, and the impact on daily life.

Negotiation often involves back and forth. Insurers may start low. They may question treatment. They may argue pre-existing issues. This is normal. The goal is to push toward fair value supported by evidence.

Filing a lawsuit when a settlement is not fair

When negotiation does not produce a fair outcome, a lawsuit may be filed. Lawsuits are not only about going to trial. They are also a tool to compel disclosure, take depositions, and pressure for a more realistic settlement.

Settlement timeline versus trial timeline

Some cases settle quickly. Others take longer, especially when injuries are complex, liability is disputed, or multiple insurers are involved. A trial timeline can be much longer than a settlement timeline, but strong trial readiness can improve settlement positioning.

Proving fault and liability in New Jersey

Fault matters because it can control what you can recover outside PIP and how an insurer values your case.

How fault is determined

Fault is determined through evidence, not just what someone says happened. Police documentation, witness statements, scene photos, vehicle damage, and expert analysis can all matter.

Comparative negligence and partial fault

New Jersey uses a form of comparative negligence. The statute provides that negligence does not bar recovery if it was not greater than the negligence of the person against whom recovery is sought, or not greater than the combined negligence of others in the case. (law.justia.com)

In plain terms, if you are found partly at fault, your recovery can be reduced. If you are found more responsible than the other side, you may be barred from recovery for that claim.

Insurers know this and may try to shift blame onto you. That is why early documentation matters.

Multi-vehicle crashes and shared liability

Multi-vehicle crashes create shared liability arguments. Each insurer may point elsewhere. Evidence and timing become even more important, and medical and wage documentation must be clean.

Common claim types that change the process

Certain crash types bring predictable complications.

Rear-end crashes, intersections, and disputed scenarios

Rear-end collisions often look straightforward, but they can still be disputed. Intersections are frequently contested because drivers tell different stories and signals may be unclear.

Hit and run claims

Hit-and-run crashes often move the claim into uninsured motorist territory. Your own policy may become central.

Uninsured and underinsured motorist claims

If the other driver has no insurance or not enough, your uninsured or underinsured coverage may apply. These claims can feel like you are fighting your own insurer, because in practice, you may be.

Commercial vehicles and layered insurance

Crashes involving commercial vehicles can involve additional policies, employers, contractors, and more complex investigations. Timelines can extend, but the available coverage can also be larger.

Damages and compensation: what can be included beyond medical bills

A claim is not only about emergency care. It is about the full impact.

Medical expenses and future care

This includes treatment already received and expected future needs. Future care can matter when injuries are long-lasting or require specialist support.

Lost income and reduced earning capacity

Lost income includes time missed from work. Reduced earning capacity reflects a longer-term reduction in what you can earn if your injury changes your ability to work.

Pain, suffering, and quality of life

Pain and suffering reflect the human impact, including daily limitations, sleep disruption, and loss of enjoyment of life. These damages require good documentation and a credible presentation.

Property damage and practical costs

Property damage is often handled separately. Rental costs, towing, and out-of-pocket expenses can still matter, and they should be documented.

Mistakes insurers use against claimants

Most claim mistakes are not malicious. They are normal human reactions to stress. Insurers simply take advantage of them.

Delayed treatment and gaps in care

Delays create doubt. Gaps create leverage for the insurer. Even a short explanation can help, but it is better to avoid the gap where possible.

Recorded statements and casual admissions

A recorded statement can lock in wording that later becomes a problem. Casual apologies can be framed as admissions. Be polite and factual, but do not speculate.

Social media

Photos, posts, and comments can be used out of context. If you claim you cannot lift your child but post a gym photo, the insurer will notice. Keep your life simple online while a claim is active.

Quick settlement pressure

Early offers can be tempting, especially when bills are piling up. The risk is that you settle before the full injury picture is clear. Once a claim is settled, reopening it is usually difficult or impossible.

When to speak with a New Jersey car accident lawyer

Some claims are manageable with basic insurer communication. Others are not. The earlier you spot the difference, the better.

Signs you need legal support now

If you have significant injuries, ongoing symptoms, or specialist treatment, speak with a lawyer. If the fault is disputed, speak with a lawyer. If you are being pushed into a recorded statement, speak with a lawyer. If PIP is delayed or denied, speak with a lawyer.

When symptoms worsen after the crash

Many people feel fine at the scene and worsen later. That does not mean the injury is not real. It means the body is complicated. Early documentation helps connect symptoms to the crash.

When multiple insurers or coverage layers appear

Multiple insurers often means delayed decisions and blame shifting. Legal support can keep the process moving and stop you from being bounced between adjusters.

Time limits that matter in New Jersey

Deadlines are where good claims die quietly. Even strong cases can fail if the legal time limit passes.

The New Jersey courts explain that, in general, the statute of limitations for a personal injury action is two years. (NJ Courts) This is also reflected in the New Jersey statute itself, which states that actions for injury to the person must be commenced within two years after the cause of action accrues. (law.justia.com)

For property damage claims, New Jersey law commonly provides a six-year period for tortious injury to real or personal property. (Nolo)

There can be exceptions depending on the facts, including cases involving government entities or special circumstances, so it is wise to speak with a lawyer early rather than treat deadlines as a future problem.

Reporting requirements and crash documentation in New Jersey

New Jersey has a separate reporting concept that many drivers do not realise exists. The state crash report form states that a driver involved in a crash resulting in injury or death, or property damage over a stated threshold, must forward a written report within ten days.

Even if you believe the police report covers everything, it is smart to understand the reporting requirements and keep your documentation organised. Missing paperwork can create insurance friction later.

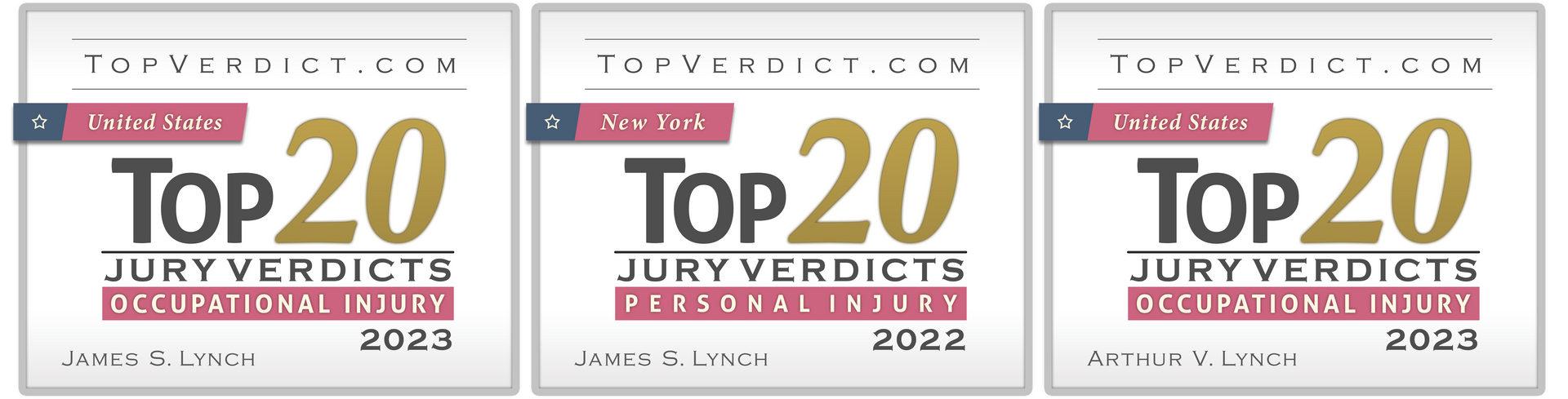

How Lynch Lawyers helps with the New Jersey car accident claim process

Lynch Lawyers represents car accident victims in New Jersey and focuses on handling claims in a way that prepares cases for fair settlement or trial when needed. Their Car Accidents page and Auto Accident Attorneys page highlight the firm’s approach to investigating crashes, dealing with insurers, and pursuing compensation through negotiation or litigation when necessary.

Investigation and evidence building

A lawyer can preserve evidence, identify witnesses and camera sources, and build the liability story early. This matters most when fault is disputed or injuries are serious.

Handling insurer communication

One of the biggest benefits is controlling communication. Instead of you fielding calls while injured, your lawyer manages the narrative and protects you from avoidable mistakes.

Addressing PIP and coverage disputes

PIP issues can involve denials, delays, and confusion about what should be covered. Legal support can push those disputes forward while the injury claim is being built.

Trial readiness that supports negotiation

Many insurers settle higher when they believe a firm will actually litigate. Trial readiness is not about drama. It is about leverage.

If you want to speak with the firm, use the Contact page to schedule a free consultation. It helps to have your crash report number if available, basic insurance details, and a short timeline of treatment so far.

FAQ

How long do I have to file a car accident lawsuit in New Jersey?

In general, New Jersey courts state that the statute of limitations for a personal injury action is two years. (NJ Courts) Specific circumstances can change deadlines, so speak with a lawyer early.

Will my PIP cover my medical bills even if I was not at fault?

PIP is sometimes called no-fault coverage because it can pay medical costs under your policy regardless of who caused the accident. Coverage details depend on your policy.

What if the other driver has no insurance

You may need to rely on uninsured motorist coverage under your own policy. These claims can involve disputes, so legal guidance can help.

How long does a New Jersey car accident settlement take

It depends on injury severity, treatment length, evidence clarity, and whether liability is disputed. Faster is not always better. Settling before your medical picture is clear can cost you.

What if I were partly at fault

New Jersey comparative negligence rules can reduce recovery when a claimant is partly responsible. The statute explains that contributory negligence does not bar recovery if it is not greater than the negligence of the person against whom recovery is sought, or not greater than the combined negligence of others. (law.justia.com)

Should I give a recorded statement to the insurance company?

Be cautious. Recorded statements can lock you into wording before you fully understand your injuries and the facts. It is often wise to speak with a lawyer first.

Protect your claim early and get help when it counts

The New Jersey car accident claim process has two big traps. The first is assuming fault automatically controls everything, when PIP and no-fault rules can change the early stages. The second is assuming you can fix mistakes later, when early documentation and early treatment often decide how an insurer values your case.

Focus on safety, get appropriate medical care, document what you can, and keep your communications disciplined. If injuries are serious, fault is disputed, or PIP and coverage issues appear, speak with a lawyer early.

Lynch Lawyers handles car accident cases across New Jersey and can review your claim, explain your options, and take over insurer communication so you can focus on recovery. A free consultation is often the simplest next step when the process starts to feel stacked against you.